Back in the comfort of my own home and the post-conference energy boost that’s likely the direct result of misinterpreted dehydration, I’m going to post a quick summary and update about the conference and some eye-opening ideas that were introduced, call it a night (morning?), and sleep in my own bed, with sheets that aren’t folded under a heavy mattress, and near an AC that actually does what I tell it to do (usually).

The conference went incredibly well, the the entire experience was a thrilling introduction into the world of organized cryptocurrency. We got a table near the exit, so many people passing by our display had already seen a large majority of the other conference presences, which led to an unexpected, but arguably beneficial information track. People from all backgrounds, levels of knowledge, and interests had to ask… “How can mining help find a cure?”

Here’s a picture of the dev team at the conference table:

- July 19th and 20th marked the information-saturated days of explaining curecoin, protein folding, and cryptographic signatures to people of all ages, backgrounds, and hairstyles.

On the left we had a laptop with the FAHViewer showing a protein simulation running with a touchscreen-lots of fascinated fingerprints streaked across in all directions. On the right, we had a monitor displaying a captioned version of the Curecoin introduction video. Left to right: Jake (FifthGhostbuster/FifthGB) Josh (Cygnus-XI), Curtis (FifthGhostbuster/FifthGB), and Maxwell (Vorksholk, me).

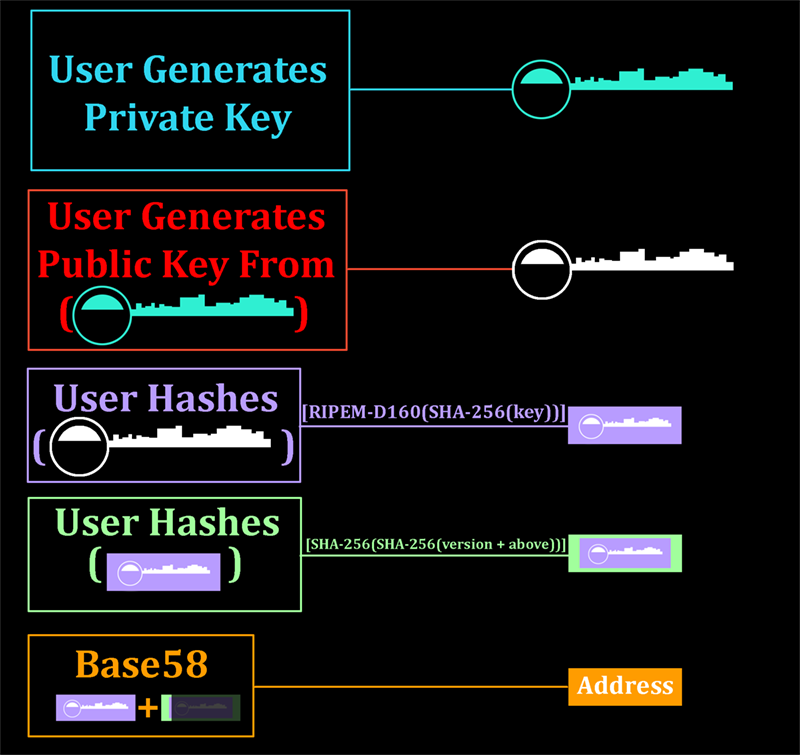

We had three explanations that we provided-a simple top-level approach of explaining the observable mechanics of the system-folding goes in, Curecoin comes out. We can explain that! The next channel was the science-based channel, which developed as a direct result of a surprising number of people fascinated by the protein folding aspect of the project-a refreshing, well-appreciated shift from the grind of cryptocurrency discussion. The final channel was based around the cryptocurrency, the future ideas for certificate blockchains, P2P certificate authority verification, decentralized voting systems to remove suspicious universities from network access, quantum-computer-resistant signing algorithms, and any other smaller aspect of the system.

As well, we noticed three main groups of people-those interested from purely a speculative investment point of view, those interested in primarily the science of the project and seeing the coin as simply a vehicle by which to arrive at communal incentivization of expediting computational research, and then the blend demographic who were interested from primarily a financial perspective, but appreciated the system for its philanthropic basis, and for the end goal of computational research. Overall, the conference introduced us to an amazing group of people ranging from scientific enthusiasts to crypto-geeks to press personnel to the refined unique characters which made up the general population’s conference representation.

In talking with such a wide variety of enthused, coffee-infused people, a few interesting points came up, one of which I want to go into greater detail today.

Bitlicenses. New York, in the competitive times that are states setting precedents for legislation, is moving full-speed-ahead on publishing legal guidelines for the use of Bitcoin. While I will be the first to admit I have not had the time to fully settle in and read the entire proposed piece of legislation, a few parts stick out at me as the word of the law and the spirit of the law conflicting.

Let me start off this platform for an open discussion with this: I am pro-regulation in most cases. It is the government’s job to protect the small players-the people who don’t have access to insider information. The small-time investors put a bit of money in because they believe in a project, not because they have the power to manipulate it and steal from others. Cryptocurrency manipulation runs rampant in today’s markets. On a daily basis, new coins are released, powerful miners, developers, and other assorted insiders collude, pump coins, generate interest, and take advantage of the inflow of fresh cash which is in hopes of a recovery from the last artificial spike and crash to take money away from those who don’t have an inside into the system. As it functions today, many people lose money in unfair ways. Investing in a company, stock, or currency you have faith in shouldn’t be something you have to worry about manipulation in. Just as the stock market ideally works today, people invest in something because they believe it has potential. Businesses made for the purpose of artificially inflating stock prices to take advantage of traders are not only doing something nearly everyone agrees is immoral-but are also breaking well-known legislation in most, if not all, developed countries.

Such a system does not currently exist to curb the scamming of deceived small investors in the world of cryptocurrency. As one of the developers of a cryptocurrency which hopes to break away from this image and emerge as a legitimate player in legitimate markets, such market manipulation is harmful. Such market corruption is damaging to the image of cryptocurrency the community so desperately needs to improve. Such market collusion pushes small investors-people putting in a few hundred dollars into the world-sewn boxing ring of crypto battles-to become disillusioned, disheartened, and defeated. Crushing the lifeblood of a product is no way to treat a customer base, is no way to treat people who believe in your project, and is certainly no way to move towards further public and governmental acceptance of cryptocurrency.

In summary of the above wayward confusion neatly separated into two innocent paragraphs, regulation can be good. Not only is regulation an inevitable step towards mass market adoption, regulation is an essential step towards mass market adoption. It is required for the very big players to play. However, the important differentiation here it ensuring that the very big players don’t change the rules of the game for themselves. As the proposed, early-draft legislation from the New York state government stands, Bitlicensing would be an expensive, required step towards providing money services based on cryptocurrencies based in New York, or having anything to do with anyone in New York. To step back, let’s analyze whether geopolitical lines arbitrarily corralling a segment of the U.S. population into a smaller subservient government working within the graces of a larger legislative body dictate much about internet traffic. As it stands, packets sent from one computer to another pass through a multitude of different parts of different states, countries, and international areas to reach their destination. They do not do so in a manner which is easily controlled, changed, or even predicted. As such, a transaction involving only people in two states which don’t even touch New York may see traffic routed through New York. Assuming that the word of the law doesn’t consider this a transaction through New York, we can simplify the model to any transaction where one or more end parties (sending, receiving) are based in the Empire State. In such a case, providing a money service to a user in New York would appear to be illegal without the use of a bitlicense. In the proposed systems, bitlicenses have the likelihood to be prohibitively-expensive to obtain and maintain.

For the current system Curecoin uses, with payouts from a central system (subject to change with the introduction of the certificate blockchain), this would likely put our payment system under fire. The spirit of this legislation, as I interpret it, essentially dictates that regulations are meant to keep consumers safe-to protect the small investors, the low-volume traders from a repeat Mt. Gox incident. The spirit of this legislation is one that is not only logical, but also one that has been long overdue in the crypto world. However, the way the bill is worded (and a fancier post tomorrow will delve into more detail once I have time to read the legislation in its entirety and form a fully-baked opinion on the matter), collateral damage is likely to occur where it wasn’t intended to spread. Systems like Curecoin using a hold-over payment system until the final Curecoin software is released, and other currencies doing any kind of centralized distribution, would be subject to legislation not intended for them. Such legislation would not be a problem if bitlicenses were trivial to obtain and use, while still protecting speculators and other users of the money service. Exchanges that don’t run with money or get attacked by hackers successfully are an essential component of the crypto world, and holding them legally responsible for their actions is a fresh breath of air. However, if by cost bitlicenses stop cryptocurrencies from being created to follow certain distribution models, lots of potential innovation is scrapped, public trust in the system is forced into the centralized hands of financial institutions large enough to pay exorbant amounts of money to acquire such licensing, and movements towards other alternate solutions, such as anonymous coins, become likely.

From the perspective of all parties involved-from regular interested citizens to software developers to large and small business to governments around the world-sane, logical, well-debated legislation is an essential component of a successful future. The current bitlicense system would prevent the creation of bitcoin banks. The legislation, as it is presented now, would require any person or business holding other people’s currency to have it fully represented in alternate cash. Which means, if we hold a large amount of Curecoins in cold storage for payouts, we have to have, on-hand, the US dollar value for all of those coins. It’s even worse for banks, who can’t even function as normal banks, but only as cold storage for Bitcoin, a system curtailing the very essence of the banking industry today. Such stifling legislation was certainly not intended to hurt large financial institutions who were planning on conducting perfectly legal, reasonable bank practices with cryptocurrencies. They were also not meant to target large coin distribution systems. They were created to protect consumers from asset loss, and were done in such a way that the system in which assets could potentially be lost would be prevented from ever existing.

This is not the final draft of the legislation, there is a 45-day comment period for everyone to submit comments to the New York State Government pertaining to the proposed legislation. I have no doubt that this system will be improved greatly before launch-but now is the time to act. It is much easier to change legislation before it is passed, and in this case, much less damaging both to the cryptocurrency world and any players, bit or small, who are interested in providing financial services related to cryptocurrencies. A more detailed post will follow tomorrow or the next day with specific information, accommodated by my own text analysis of the proposed legislation. I am no lawyer, and I am no financial advisor, so I’ll be deferring to many final judgements from qualified professionals who have already expressed their opinions online.

In the event that such a system were to pass, Curecoin would be required to put forward a good-faith effort to stop any New York citizens from taking any part in the Curecoin network. If this becomes a potential requirement, we will modify the pool to block New York IPs and to force all users to agree that they are not from New York to begin using the service. Clearly, this legislation is damaging to consumers-New Yorkers who already own and hold Curecoin, who will no longer be, due to legal requirements, supported by the Curecoin project. This may not be necessary after the introduction of a certificate blockchain due to Curecoin no longer having direct (or even indirect) control over the coins.

As a summary, legislation and regulation is a good step in the right direction for protecting consumers and allowing large financial institutions to work with the currency in a sane manner. However, the currently proposed legislation likely not only oversteps the bounds of federal financial regulation, but also clearly doesn’t properly serve its intended purpose, and certainly doesn’t minimize collateral damage. Talk with your government. Hop on #curecoin on freenode, let’s talk.

Read More